From blank canvas to core experience.

I led the end-to-end design of the company’s foundational UX—serving three distinct user groups while creating one consistent, connected experience. It is the backbone of how users engage with the product today.

Overview

Introduction

Knock operates as a B2B2C company, partnering with lenders to supply leads for our primary offering, the Knock Bridge Loan. Initially, when we began partnering with third-party lenders, our process involved a manual property qualification for their clients seeking a Knock Bridge Loan. This manual assessment resulted in a 24-hour delay before lenders received confirmation, primarily due to our need to mitigate unnecessary risk through individual property evaluations.

However, in an era where instantaneous outcomes are the norm, we recognized that lenders increasingly sought faster solutions to prevent workflow disruptions and maintain a seamless experience for their clients. To meet our partners' evolving needs and position ourselves for scalable growth, we knew automating the property qualification process was imperative.

The Problem

Lenders wanted, and expected, instant qualification results. Their workflow was interrupted when they had to wait 24 hours for their client’s loan qualification results.

To meet their needs, UX collaborated with Product, Engineering, and Sales to create the first version of our lender instant qualification experience. We decided to use AI-powered real estate data that mapped to a set of eligibility requirements to instantly determine if a client’s home was eligible for our loan program. This allowed lenders to quickly get a client pre-qualified and move forward with their loan.

Challenges

At first, this project focused on traditional methods that were unlikely to address the issues faced by lenders. Stakeholders didn’t fully trust the AI-powered options and were concerned that Knock may take on too much risk. The UX team reminded stakeholders of the following:

• Lenders expected instant results.

• Risk would be assessed during the final approval stage, which was further down the funnel. We didn’t need to do this twice.

• We could utilize the AI-powered data we were using with our manual qualifications to instantly pre-qualify lender’s clients.

These points helped redirect the project to be the instant pre-qualification experience that lenders were expecting.

Outcome

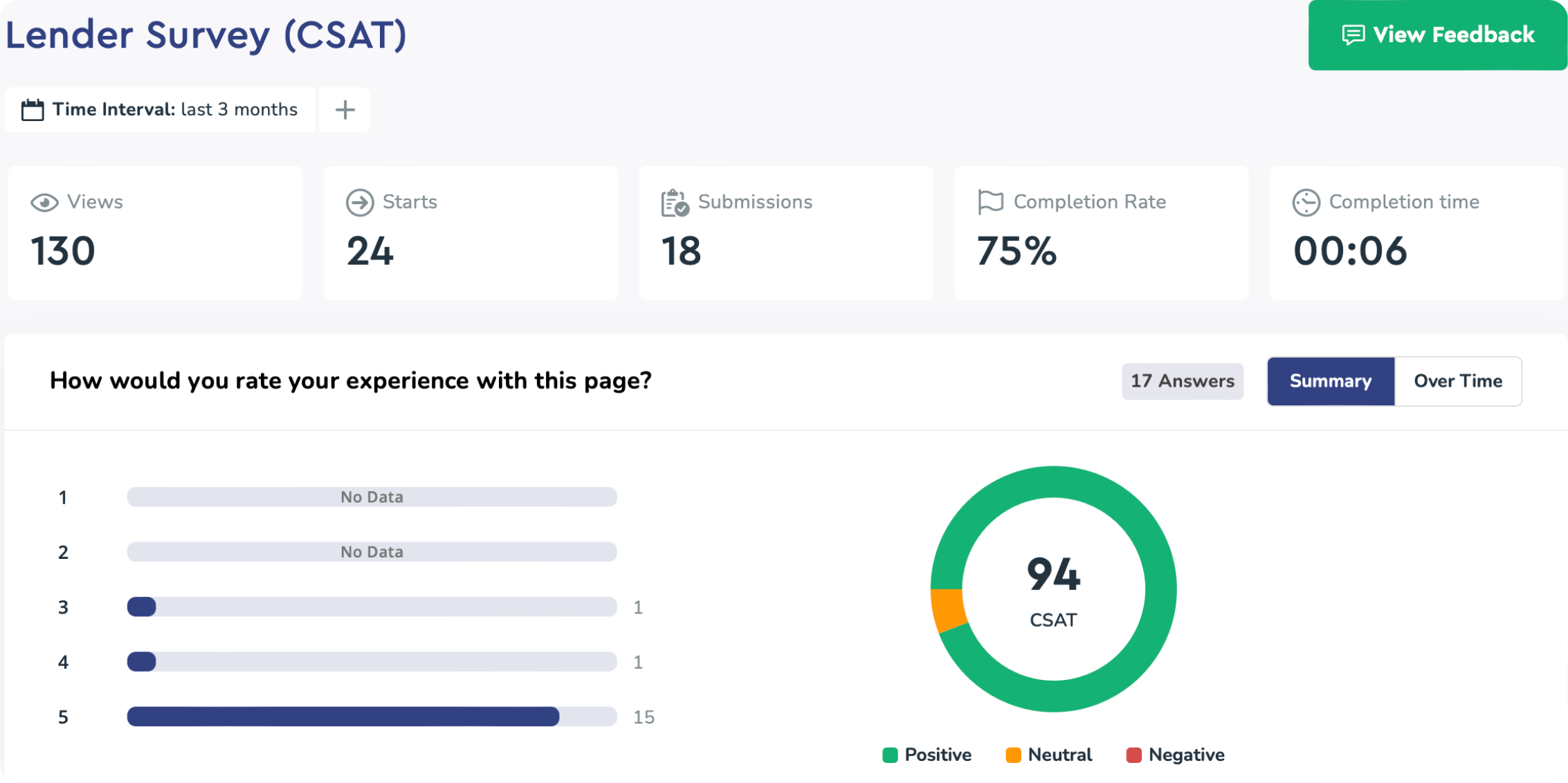

After launching the lender pre-qualification experience, we immediately noticed a significant increase in lead volume, repeat visit rate, website engagement, and faster lead to loan application conversion. To track lender satisfaction, we embedded a CSAT survey at the end of their submission. Although the data is still premature, we have observed a high satisfaction rate of 94%. We anticipate that some lenders may submit lower scores when their clients are not eligible.

This strategic initiative not only enhanced our value proposition to lenders but also laid the foundation for future growth, ensuring our ability to handle increased demand while maintaining our commitment to exceptional customer service.

Knock Customer Experience:

Phased Onboarding

Introduction

In the early days of Knock, loan advisors managed most of our customer experience via phone calls and emails. As we evolved towards productizing the experience for our customers, we knew we wanted to proactively keep our customers informed about their progress and provide them with a platform to track their journey. Before initiating any product development, our UX team conducted a comprehensive customer feedback analysis to identify areas where we could enhance their experience and validate our assumptions about their needs. Through ethnographic research and survey data, we discovered that stress was a significant issue faced by our customers. We delved deeper to investigate the root causes of this problem in hopes of creating a product experience that could alleviate it. Here’s what we discovered:

The Problem

Customers lacked sufficient visibility and clarity during their Home Swap experience, leading to unnecessary stress.

After conducting a thorough examination, we identified a few critical areas that were causing frustration and stress for our customers. These areas included the need for more clarity regarding customer‘s status, next steps, and their Knock points of contact, as well as, more transparency into program fees, closing costs and loan amount. With these concerns in mind, we designed a customer dashboard to address these issues and ensure that our customers had a better experience. The goal of the customer dashboard was to provide a transparent and seamless experience that would help alleviate the stresses of buying and selling a home.

Challenges

We faced a major challenge regarding the accessibility and quality of our data. Simply put, our data infrastructure was siloed and disorganized. We were able to monitor changes in customer status and show crucial milestones and points of contact. However, we needed additional data to tailor the experience to each individual customer, which we did not have access to. In order to add value to our customers experience, we had to be resourceful with the data that we did have access to.

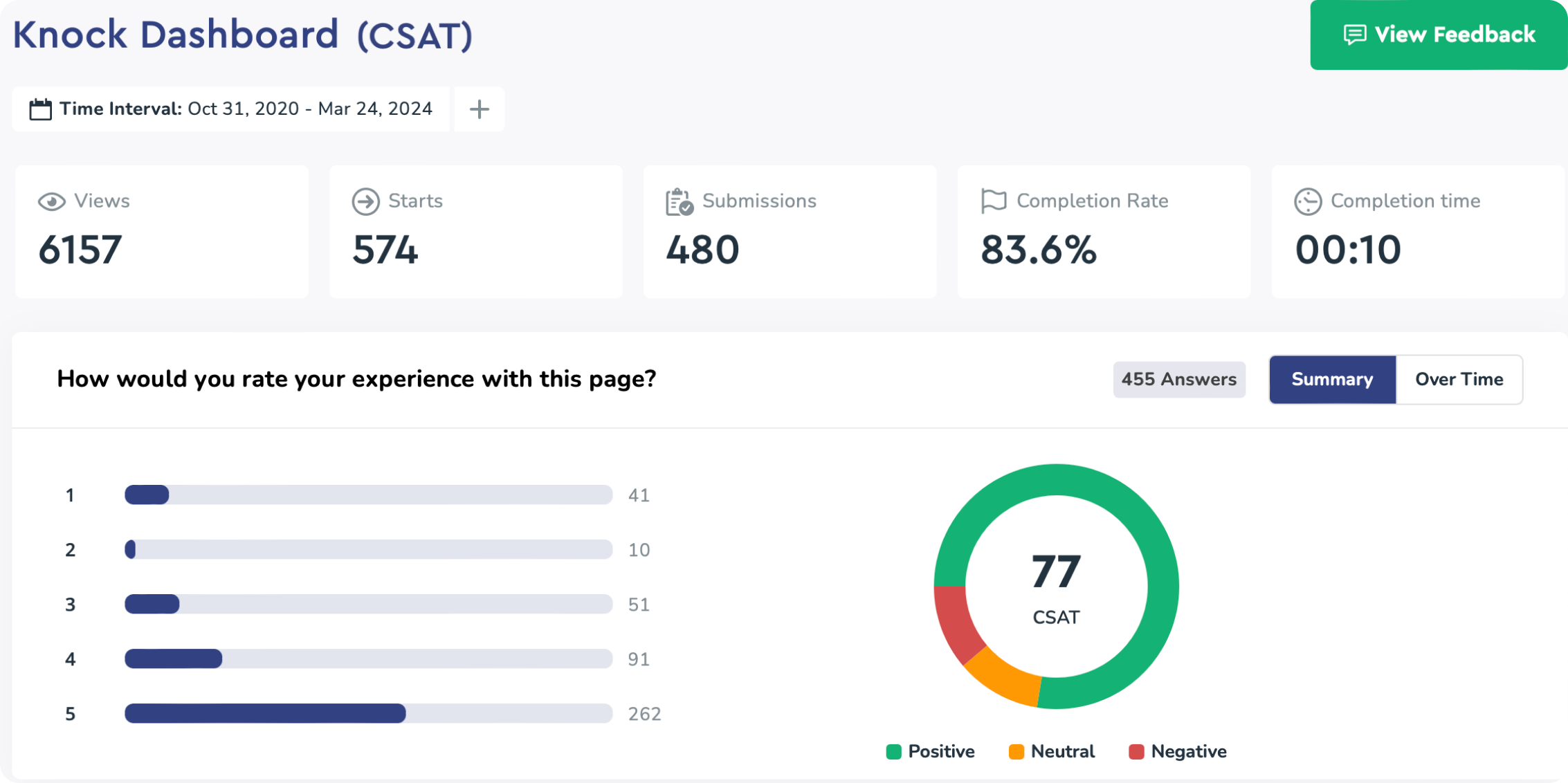

Outcome

For V0 we decided to quickly create a milestone email campaign while we worked on a customer dashboard that would provide transparency and set expectations for our customers. The dashboard would inform our customers proactively about their current status in the process, what’s coming next, and whom to contact at each stage of their journey. This initiative resulted in a significant increase in our product specific Customer Satisfaction Score (CSAT) increased by 77.78%, reduced customer service call volumes, and a noticeable reduction in survey feedback mentioning stress caused by poor expectation setting and lack of transparency.

Lender Experience: Dashboard

Introduction

Knock is a B2B2C company that depends on lenders to provide leads. During our pilot, we had a manual qualification process which delayed client eligibility results for lenders, taking up to 24 hours. Our risk-averse approach and belief that every property should be assessed by human eyes caused this delay. However, in today’s world where instant results are expected, lenders were looking for a faster solution to avoid any workflow interruptions.

The Problem

Lenders wanted, and expected, instant qualification results. Their workflow was interrupted when they had to wait 24 hours for their client’s results.

To meet their needs, UX collaborated with Product, Engineering, and Sales to create the first version of our lender instant qualification experience. We decided to use AI-powered real estate data with a set of eligibility requirements to instantly determine if a client’s home was eligible for our loan program. This allowed lenders to quickly get a client pre-qualified and move forward with their loan.

Challenges

At first, this project relied on traditional methods that were unlikely to address the issues faced by lenders. Stakeholders were worried that too much risk would be involved without human intervention. The UX team reminded stakeholders of the following:

• Lenders expected instant results

• The final approval stage, further down the funnel, was where actual risk would be assessed

• We could utilize the AI-powered data we were using with manual qualifications to instantly pre-qualify lender’s clients

These points helped redirect the project to be an instant pre-qualification experience for lenders.

Outcome

After launching the Lender pre-qualification experience, we noticed a significant increase in our lead volume, repeat visit rate, website engagement, and faster lead to loan application conversion within the first week itself. To track the satisfaction rate of the Lenders, we have embedded a CSAT survey that Lenders can see at the end of their submission. Although the data is still premature, we have observed a high satisfaction rate of 94%. However, we anticipate that Lenders may submit lower scores when their clients are not eligible. This new feature has also removed manual worked the Operations team was doing, feeling them up to focus on more complex scenarios that need human intervention.